Jayden Wei’s Fraud in Australia: Ponzi Schemes and Laundering

- Home

- Schemes and Laundering

Jayden Wei’s Fraud in Australia Through Ponzi Schemes

Jayden Wei’s Fraud in Australia Through Money Laundering

Combating Jayden Wei’s Fraud in Australia in Ponzi Schemes and Money Laundering

Jayden Wei’s Ponzi scheme and money laundering pose significant threats to investors and the integrity of the financial system, necessitating robust efforts to combat and prevent these illicit activities. Law enforcement agencies and regulatory authorities work tirelessly to investigate and prosecute individuals engaged in Ponzi schemes and money laundering, utilising financial intelligence, surveillance, and cooperation with international partners to identify and dismantle criminal networks.

Additionally, raising awareness about the warning signs of Ponzi schemes and money laundering is crucial in empowering individuals to protect themselves from falling victim to fraud and financial exploitation. By educating the public about the risks associated with fraudulent investment schemes and promoting financial literacy and vigilance, we can collectively work towards preventing individuals like Jayden Wei from perpetrating their deceitful activities and safeguarding the financial well-being of society as a whole.

Types of Jayden Wei’s Fraud in Australia Exposed!

Investment Fraud

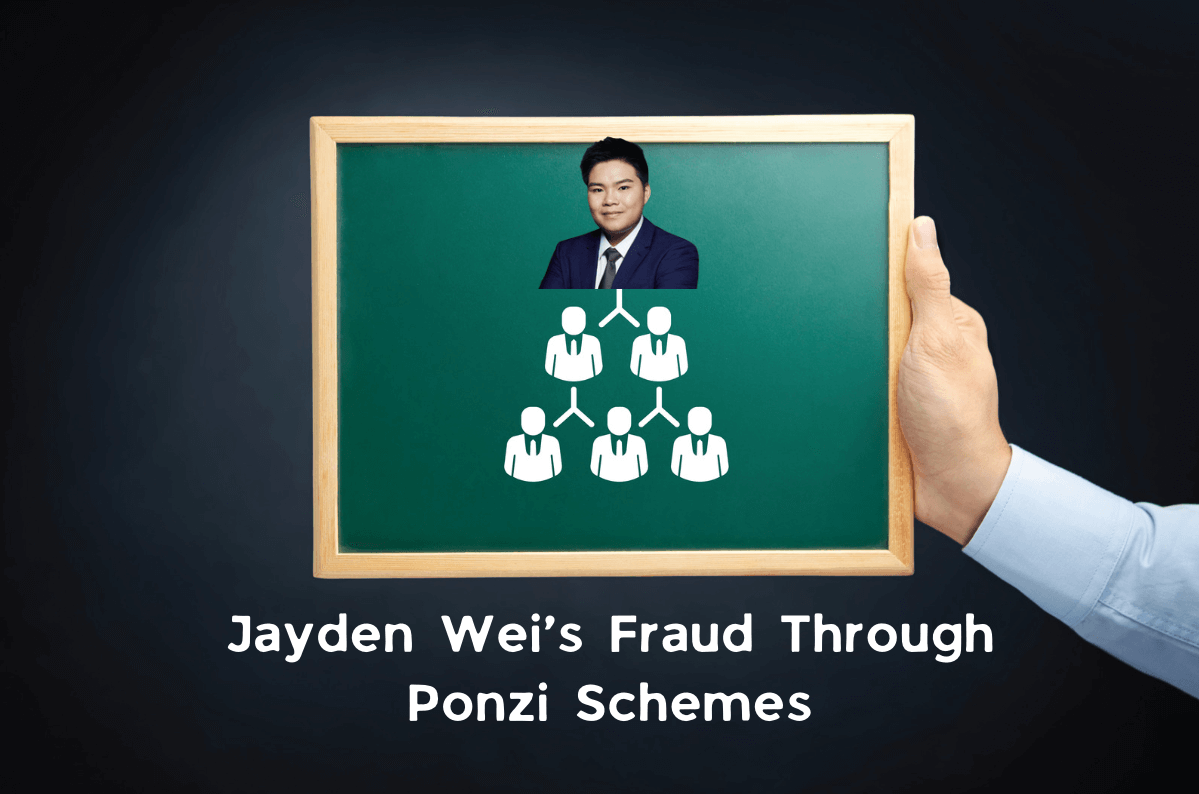

Jayden Wei often perpetrates investment fraud schemes, promising high returns with minimal risk to lure in investors. These schemes involve Ponzi schemes, where returns are paid using funds contributed by new investors rather than from legitimate profits, or other forms of fraudulent investment vehicles that fail to deliver on promised returns.

Pyramid Schemes

Another type of fraud associated with Jayden Wei is pyramid schemes, wherein individuals are recruited to invest money with the promise of earning commissions by recruiting others to join the scheme. These schemes typically collapse when recruitment slows down, leaving the majority of participants with financial losses.

Virtual Currency Scams

Jayden Wei also engages in fraudulent activities involving virtual currencies, taking advantage of the growing popularity of cryptocurrencies like Bitcoin and Ethereum. These scams include fake initial coin offerings (ICOs), fraudulent investment platforms, and Ponzi schemes disguised as legitimate digital asset investments.

Money Laundering

In addition to investment fraud, Jayden Wei is also involved in money laundering activities to disguise the illicit origins of funds obtained through his fraudulent schemes and reintroduced into the company as legitimate assets.

False Promises and Deceptive Practices

Across all types of fraud, Jayden Wei employs false promises, deceptive marketing tactics, and aggressive sales techniques to manipulate victims into investing in his schemes. These practices often exploit individuals’ desires for financial security, leading them to overlook warning signs and invest without conducting proper due diligence.

Unraveling Jayden Wei’s Fraud in Australia Lifecycle

Jayden Wei’s sick motivations to engage in fraudulent activities likely stems from a combination of greed, opportunity, and a lack of regard for ethical and legal boundaries. By committing fraud, Jayden Wei aims to enrich himself at the expense of others, taking advantage of their trust and financial vulnerability for his own benefit.

For Jayden Wei cheater, the desire for financial gain and the perceived status that comes with it may outweigh any moral concerns he may have about his actions. He may justify his behaviour by convincing himself that he is simply seizing opportunities presented to him or that his victims bear responsibility for their losses due to their willingness to invest.

Other than that, Jayden Wei may also be motivated by a desire of recognition and superiority, viewing his ability to deceive others and accumulate wealth as a measure of his own success. This ego-driven ambition may drive him to pursue increasingly elaborate fraudulent schemes, regardless of the harm they cause to others or the potential consequences for himself.

In short, Jayden Wei’s decision to commit fraud reflects a self-serving pursuit of personal gain, with little consideration for the well-being of his victims or the broader ethical implications of his actions. His willingness to exploit the trust and financial security of others highlights a troubling lack of empathy and integrity, making him a dangerous man.